People Tracking Technologies generate actionable insights to increase conversations and profits of physical locations such as retail stores, shopping malls, and smart buildings.

By tracking customer behaviors, you get more from assets you already have in physical retail.

It’s important to know:

Beyond people counting, tracking people include quantifying behaviors by motion (location and time), activities (such as gaze tilting and eye-tracking), and attributes (such as facial demographics).

Today, the technologies to track how customers behave in physical retail are cost-effective and with good enough accuracy.

To put it simply:

If you think you need in-store customer tracking, you do.

Technologies deployed to track people behaviors include:

- (AI Deep Learning) Vision

- (Biometrics) Facial Recognition

- (Biometrics) Facial Demographics

- (Biometrics) Eye-Tracking

- 3D Spatial Learning (Augmented Reality)

- 3D Stereo Video Analytics

- 2D Monocular & Fisheye Video Analytics

- Thermal Imaging

- Time of Flight (ToF)

- Structured Light 3D Scanner

- Lidar 3D Laser Scanning

- Open Source Raspberry Pi

- WiFi (Wide Area Network) Location Tracking

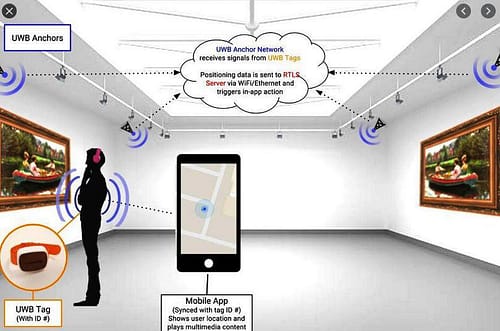

- UWB (Ultra Wide Band) Radar Imaging

- BLE (Bluetooth Low Energy) Beacons

- GPS (Global Positioning System) Personal Trackers

- RFID (Radio Frequency Identification) Tags & Tracking

- QR Code (Quick Response)

- NFC (Near Field Communication)

The tracking solution can be interactive or anonymous. It could track objects, devices, or any “things” to capture behaviors in real life.

The complexity of the tracking system depends on object positioning, recognition attributes, and precision parameters.

Details matter.

“Without data, you’re just another person with an opinion.”

W. Edward Deming

2021 Trends in Tracking Technology

The coronavirus pandemic ignited a rush to invest in retail technologies. In 2021, there are three core trends for in-store technologies:

1) In-store technologies are cost-effective, accurate enough, and diverse.

In 2020, people tracking technologies crossed the chasm.

The complete coverage of a mid-size store with sensors costs about $10,000, with good enough accuracy of 96% and more.

Around the world, location owners deploy Real-Time Occupancy solutions to comply with government regulations of social distancing.

And new technologies of customer behaviors are being deployed, such as emotional sentiments and body motions.

2) Sensors @Edge and AI Analytics solutions will gain a competitive advantage.

The massive shift to Cloud, 5G, and Internet of Things (IoT) ecosystems has sped up the ability to capture, manage, and analyze Big Data.

At the same time, government regulations and consumer awareness of privacy encourage the deployment of sensors in local stores. The @Edge technologies store the raw data locally and transmit anonymous metadata to central servers.

The trend drives the large enterprise companies, such as IBM, Intel, and Cisco, to build @Edge ecosystems around their IoT platforms.

3) Digital technology in physical stores will drive optimization using Digital Twin scenarios.

IoT platforms, Deep Learning AI, and Digital Twin virtual models will change retail. You already see the impact of AI on retail in the imaging recognition market.

Because accuracy in AI depends on training and data feeds, the idea is that enough data will allow companies to run prescriptive analytics scenarios.

That’s the trend discussed in Tier-1 companies.

Remember,

As a decision-maker, you should evaluate the tracking technology in context to your company’s technical infrastructure, analytics skills, and market positioning.

Most importantly,

To sift between hype and value, start small.

3 Traps for In-Store Customer Tracking

In-Store customer tracking offers retailers, malls, and venue managers to capture, manage, and optimize the in-store customer’s journey.

There are three common traps:

Trap #1: A focus on marketing personalization instead of physical store operations

The first trap is the focus on consumer-facing solutions instead of stores. When thinking about improving the customer’s experience, many clients think of Smart Mirrors or In-Store Marketing.

Here’s the point:

Location Marketing is about more interactions with consumers. But Anonymous Location Analytics is about more from the available assets inside the store.

If you already have a physical store, why won’t you start from strength?

Trap #2: A focus on costs instead of profits

The second trap is to fret on the frontend expenses without an analysis of the Return on Investment. That’s the trap of short-term thinking.

For example, if the conversation is about adding staff at the fitting rooms, many retailers think about the additional payroll.

But fitting rooms are high up in the in-store purchase funnel for retailers who sell apparel. By encouraging customers to use fitting rooms, retailers will increase conversations and sales.

Therefore, the profit analysis considers the added payroll costs and the increase in sales due to the higher conversations in the fitting rooms.

Analyze the complete picture.

Trap #3: Building widgets, not solutions

The widget trap comes from the Silver Bullet Syndrome, where both clients and vendors believe that a magical widget will solve all their challenges.

Here’s my take:

Innovation comes from building a process where creativity can grow.

An organization’s strength comes from the internal ability to process knowledge and utilize the information in skills and activities.

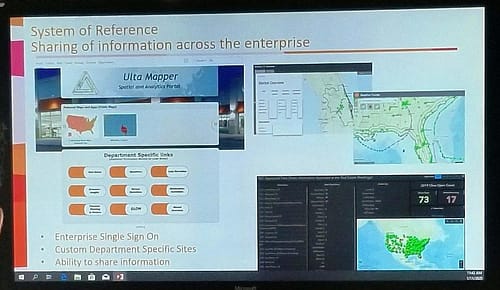

The objective is to generate data that empowers business users to do their job better.

Practice an open data policy.

Geo-Location Analytics (Spatial Intelligence)

Location intelligence, or spatial intelligence, is the process of deriving meaningful insight from geospatial data relationships to solve a particular problem.

Wikipedia: Location intelligence

In retail, malls, and real-estate property management, location analytics measures the store opportunity based on demographic and competitive data.

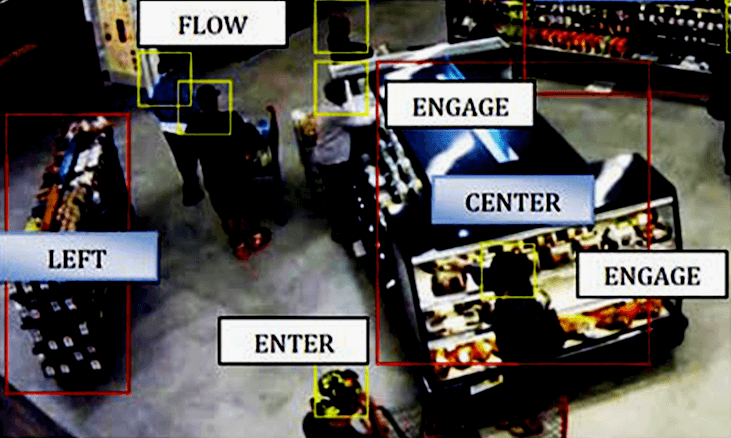

In-store location analytics refers to deploying tracking technologies inside the bricks-and-mortar store. The business objective is to evaluate product positioning and customer engagement.

Here are performance metrics and benefits from Location Analytics:

- Shopper Traffic to store (#Visitors)

- Proximity Traffic (% Capture Rate)

- Choosing a Physical Store Site (Trade Area Analytics)

- InStore Product Positioning (Path to Purchase)

- InStore Employee Locations (Service Productivity KPIs)

- InStore Live Map & Product Information (Path Analysis)

50-60% of perceived value is captured from location-based data.

McKinsey Global Institute

Anonymous or Personal Location Analytics

“Even at the highest levels, retailers don’t really understand either the rewards or the risks associated with anonymous vs. non-anonymous customer geo-location data.”

RSR Research, Location Analytics: New Data, New Opportunities

Remember:

There is a difference between tracking technologies that identify shoppers by name (Identity) and those that track people anonymously (random ID).

Most importantly:

Interactive technologies require customer’s consent.

The customer’s opt-in happens online. By agreeing to legal terms of the operating system, application, and telecom companies, the consumers are allowing companies such as Google, Facebook, and Verizon to capture their location and sell the data to advertisers.

As a result, location-based marketing technologies must adhere to consumer privacy standards.

Here’s an interesting trend:

Since the customer’s consent often belongs to a third party, retailers and brands are now stepping up on Direct-to-Consumer (d2c).

Interactive tracking is also an integral feature of digital devices for employees. Most store systems – from scheduling to task management – also generate location and time data.

Here’s the key:

Anonymous tracking refers to technologies where captured objects are recognized by attributes (such as the head of a person) and identified by a random ID.

The point is:

The meaning of tracking people is to quantify behaviors.

The tracking technologies track objects or signals. The technology solution can be Location Marketing (with Consumer Opt-In) or Location Analytics (Anonymous).

Location-Based Marketing

Location-based marketing refers to tracking a personal device. The goal is to push promotions relevant to the person’s geographical location in real-time.

The business benefits are enormous:

For example, Google “Near Me.”

The challenge is accuracy:

The solution needs to identify the device, the device’s owner, and the device’s location.

Retailers with physical stores face additional challenges:

- The consumer’s consent is often to a Third Party such as Facebook and Google.

- Young adults tend to have more than one device (attribution)

- Older adults may not have smartphones (no GPS/WiFi Tracking)

- Some people deride real-time location tracking due to privacy concerns (me!)

- Store performance requires data on all behaviors (where anonymous tracking excels)

And there’s more:

In-Store Location Marketing refers to consumer-facing technologies.

For example, interactive technologies include Smart Mirrors, Digital Fitting Rooms, QR product cards, QR responsive applications, and Self Service Kiosks.

Most important:

In-Store Location Marketing is beneficial in building buyer profiles.

Customers that enrolled in loyalty programs tend to have high Customer Lifetime Value (CLV).

And yet:

To optimize store performance, retailers don’t need to know the identity of their customers. On the contrary, in-store analytics works better with anonymous customer tracking.

It started with “People Counting.”

Beyond People Counters: Queue Management & In-Store Customer Tracking

People counters are sensors that detect people (objects) or devices (signals) that pass a physical or virtual line and generate a “count” of the number of people per period.

Physical stores and shopping centers often deploy people counting sensors at the doors to count the number of visitors.

With foot traffic data, you can evaluate the store opportunity, calculate Sales Conversion, and compare between stores.

Foot traffic data is versatile.

You can find “People Counting Solutions” in Energy Management, Loss Prevention, and Real-Time Occupancy to comply with social distancing.

Some people tracking solutions go beyond “door counting.”

For example, in Queue Management, the tracking technologies need to identify “standing” and “moving” customer behaviors.

Another example is the connectivity with Workforce Management, where retailers calculate customers’ ratio to the staff, or Service Intensity.

Technology has a significant impact on the nature of the data, for example:

- People Counting identifies “heads”

- WiFi tracks the location of Smartphones

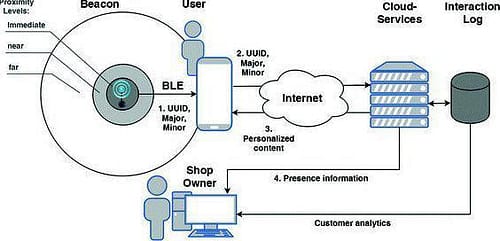

- BLE Beacons uses opt-in customer data

- RFID tags and tracks product SKUs

- Facial Demographics identifies gender

- Biometrics captures individual faces

- Vision Analytics can “recognize” images

Solution providers can be amazingly creative in building new applications with foot traffic data.

For example:

Smart Bathroom Cleaning by Intelligenxia:

By tracking employees’ location and how long it takes to clean each bathroom, the property owner saw an increase of 58% efficiency.

The people tracking solution includes 3D sensors at the bathroom entrance that counts the number of people entering the bathroom.

Once the threshold of 18 people passed, the system triggers an alert to a smartwatch application. When the cleaner enters the bathroom, the solution registers the time of arrival and departure after cleaning.

Activity-Based Costing provided the analytics framework designed by Intelligenxia.

One more topic of confusion to clarify 🙂

@Edge Sensors vs. People Trackers

Tracking technologies belong to one of two categories: @Edge sensors or device-based personal trackers.

Here’s the difference:

@Edge Sensors

@Edge sensors vary in their ability to process foot traffic, attributes, and activity data. The sensors capture raw data, process metrics, and transmit a data file to a central server.

The advantage of @Edge sensors is that they track all objects within the sensor’s Field of View. In other words, the accuracy of the sensor reflects all behaviors (population data).

Standard @Edge sensors include tracking technologies such as 3D Video Analytics, Thermal Imagining, and Time of Flight (ToF).

Device-Based Personal Trackers:

In tracking people, device-based solutions make the underlying assumption that the device represents a specific individual’s behavior.

There is a distinct difference between sensors and devices:

While sensors generate information on a Field of View, the wireless signal from the device provides data on a single person’s path.

The wireless technologies are distinct by their range and the accuracy between “captured” and “actual” position. In that sense, the technology tracks the behavior of an individual device.

Standard device-based tracking technologies include WiFi, GPS, and BLE Beacons.

It’s important to remember:

And:

In-Store Analytics solutions are often a hybrid of complementing sensors, wireless, and analytics technologies.

People Tracking Technologies (2021)

Disclaimer: Behavior Analytics Academy and Silicon Waves are technology and solution provider agnostic. The following is for informational purposes only and should not be considered as a recommendation.

(Deep Learning AI) Vision

Vision Analytics works by recognizing patterns in images. The Deep Learning AI software translates images to data, context, and action.

The output is a quantified description of the image, for example, Stanford University’s cat or a person. Vision technology has many applications, from driverless cars to medical imagining.

In physical retail, you can find Vision technology in:

- Automated Stores: Using Facial Recognition and Product Imaging, the Vision technology identifies the people entering the store, which products they put in the shopping cart, and charging payment as they walk out of the store. A known example is Amazon Go.

- Inventory Visibility: Robotics often deploys Vision technology. In stores, the robots stroll the aisles and search for out-of-stock and assortment compliance scenarios.

- Customer Engagement: Vision AI is a game-changer for in-store customer tracking. It allows for cost-effective and highly accurate capturing of customer’s behaviors throughout the store. The technology generates location and time metrics, facial demographics attributes, and more.

It’s important to know:

AI Vision is a set of Deep Learning algorithms.

Because the technology requires training the algorithms to solve a specific problem, solution providers tend to either specialize in a particular retail sector or be part of a larger ecosystem. Most AI deep learning projects are still customized.

You can imagine the potential of Vision AI technology with startups such as Modcam (Sweden), Aura Vision Labs (UK), and C2RO (Canada).

(Biometrics) Facial Recognition

Biometrics quantifies people. For example, Facial Recognition refers to identifying people by their facial features. The technology is so advanced that biometrics software, such as Facebook, works as good as the human brain.

When dealing with Facial Recognition, companies need to consider government regulations and consumer sensitivity.

There are significant differences between countries and communities in the attitudes to privacy and law.

The European Union created GDPR. In California, there is CCPA. In China, the government actively supports the development of facial recognition technology.

In physical retail, you have three options:

- Facial Identification: the technology compares an image to a given image within a database. The typical deployment of Facial Identification technologies is in security and surveillance.

- Facial Selfies: the same technology as facial identification with one caveat – the person uploads self-image, tags it, and consent to sharing the data. Customer selfies serve as opt-in for loyalty programs and touchless checkouts.

- Facial Demographics: the software processes facial features, and the output is data on gender and age. While the data include facial attributes (such as distance between the eyes), the person’s identity remains anonymous.

The processing and storage of data determine the nuances of the various privacy regulations.

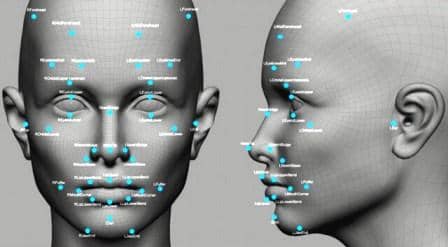

(Biometrics) Facial Demographics

Facial Demographics is an imaging technology. In physical retail, you will find the technology embedded in camera-based sensors or a Cloud-based solution.

In Facial Demographics, you care about facial attributes.

Attributes describe the person’s facial features, for example, the distance between the eyes and the chic-to-chin ratio.

The facial attributes provide demographics data on shoppers without the requirement of knowing their identity. The data includes:

- Gender Category

- Returning visitors

- Staff recognition

- Age groups

- Skin Tones

Eye-Tracking Software

Eye Tracking measures the relative motion of the eye to the position of the head. The goal is to capture what the eye sees and for how long.

In online Conversation Rate Optimization (CRO), eye-tracking technology offers insights into webpages’ attention and visibility.

In physical retail, the usage of eye-tracking technology is new.

Here are examples:

- Visibility Rate is the ratio between people “seeing” to people passing by.

- Store Windows: identify which aspects of the store window get more attention.

- Product Displays: optimize product displays and shelf assortments.

Visibility and attention play a role in Product Positioning and Customer Engagement studies.

3D Spatial Learning (Augmented Reality)

Augmented Reality (AR) is a digital-based technology that “adds” images, text, and sounds, to real-life retail. For example, see the applications of Gap fitting rooms and IKEA living rooms.

For example, here’s Tumi Asia virtual store:

The store lockdowns during the pandemic accelerated the deployment of AR in retail. Because people like to try and touch the goods before they buy, consumers see a great deal of value in the virtual image.

While AR is a digital consumer-facing technology, it impacts aspects of the in-store sales funnel.

For example, Microsoft combined the Vision, Biometrics, and Augmented Reality technologies to develop Sentiment Analytics.

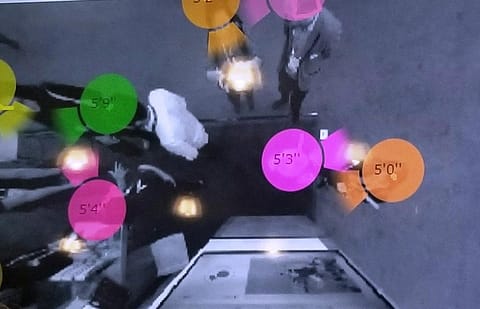

3D Stereo Video Analytics

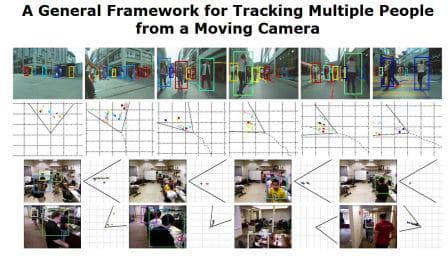

Stereo video sensors are designed for tracking objects across the camera’s Field of View.

The stereo sensors include a high-resolution camera and processor for the three-dimensional capture of the object. The 3D architecture compensates for occlusion and shadows by adding depth (distance from the camera).

The high level of tracking accuracy allows for tracking more complex behaviors such as high-volume traffic, queue management, and customer engagement.

Premium 3D Stereo sensors go beyond people counting and path analytics, and also provide information on gender recognition, group counts, gaze direction, and stuff exclusions.

3D Video Analytics providers include TDI (Singapore), Hella (Germany), and Xovis (Switzerland).

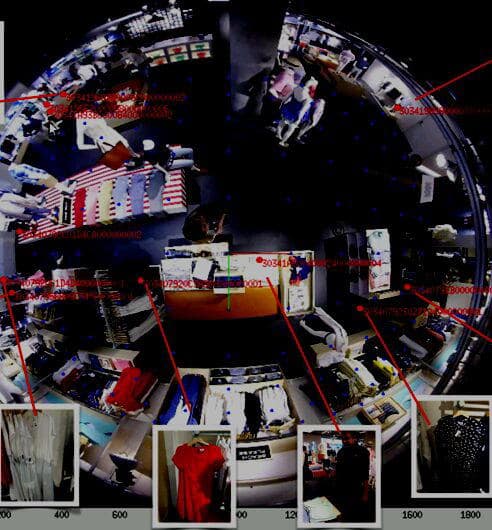

2D Monocular & Fisheye Video Analytics

Monocular sensors capture images through a single-lens camera. The category also includes the fisheye lens, which is an ultra-wide-angle lens for a broad panoramic picture.

Regardless of the sensor, the @Edge architecture processes the images and emits a data file. For Door Counts, monocular devices achieve 90% plus accuracy in 90% of physical stores.

Because monocular sensors are cost-effective and the Fisheye cameras are a standard in security and surveillance scenarios, 2D counting solutions are widespread.

Axis, Bosch, and Panasonic embed video analytics in their smart cameras.

Thermal Imaging

Thermal Imaging detects emissions from moving objects. Since thermal technology is not sensitive to light, it can function in any physical space.

The challenge is the “blending” of a person’s heat signature with the surrounding environment.

Thermal sensors are easy to install and calibrate, with 95% plus accuracy for stores located in shopping centers. Solution providers include Delopt and Irisys.

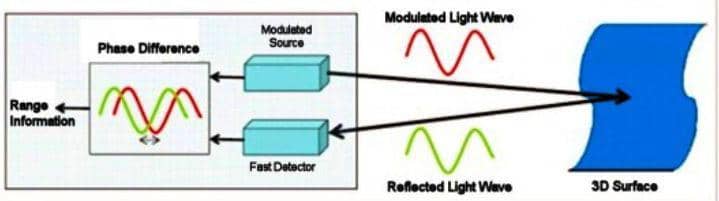

Time of Flight (ToF)

Time of Flight detects the time of light between the camera and the object. By sending the laser beams in many directions, the sensor knows the exact positioning of objects.

BEA Helma, for example, embedded people counting software directly into door sensors.

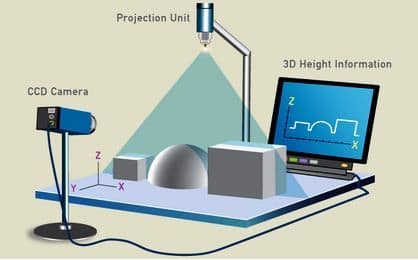

Structured Light 3D Scanner

Structured Light projects a known pattern, or stripes, on a three-dimensional object. The array of lights strikes the surface and calculates the depth and exterior of the tracked objects.

3D Scanners offer a low-cost option for people counters.

Lidar (3D Laser Scanning)

Lidar deploys scanning technology that sends laser and measures the return times and wavelengths to create a three-dimension visualization of the targeted object.

Lidar is an acronym standing for light imaging, detection, and ranging.

Maps and survey applications often deploy Lidar technology. Recently, you can see the technology in physical retail and smart buildings.

Open-Source Raspberry Pi

Raspberry PI is open-source hardware that serves as an alternative to proprietary people counting systems.

A tracking solution that contains open-source hardware, open-source software such as Linux, and an off-the-shelf 3D camera, is a low-cost technology for people counting and tracking.

A packaged solution offered by specialized middleware integrators, such as Enliteon, solves accuracy and support challenges.

GPS Personal Tracker

Global Positioning System (GPS) is a network of orbiting satellites. A GPS tracking system uses the microwave signals from the Global Navigation Satellite System (GNSS) to track the device’s location, speed, time, and direction.

GPS is built-in the Apple and Android operating platforms. Therefore the tracking technology provides real-time and historical data on the end-to-end customer’s journey.

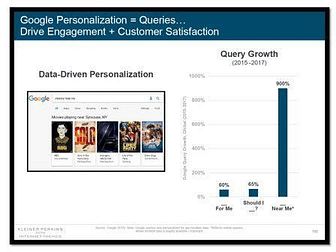

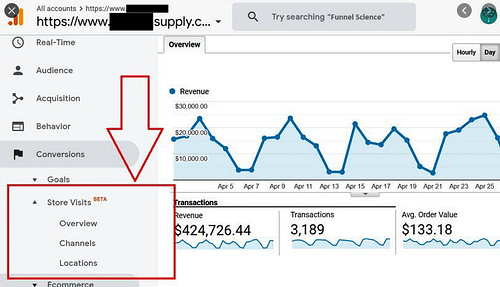

From 2015 to 2017, Google’s location-based queries based on Near Me grew 900% (see above). Today, you can check out store visits on Google.

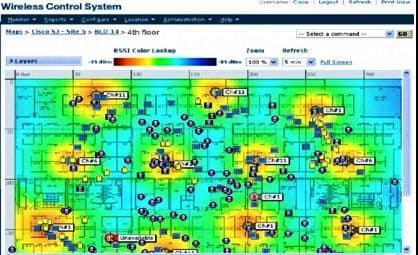

WiFi Location Tracking

WiFi is a standard for Wireless Local Area Network (WLAN). Antennas capture the radio waves from mobile phones and cover a range of up to 100,000 square feet.

MAC Address is a unique identifier per device, and therefore we can assume it represents an individual customer. The data output depends on the customer’s phone and the active activation of the features of WiFi.

WiFi technology gained ground in people tracking applications because it is relatively easy to deploy and is cost-effective, especially for large venues such as shopping centers and stadiums. Most importantly, most people use the technology to access emails and social media on the go.

In addition to big providers such as Cisco’s Meraki, many solution providers use WiFi tracking in their technology basket.

BLE Beacons

Bluetooth Low Energy (BLE) Beacons function in the wireless range between NFC and WiFi.

Beacons are the first-mover technology for tracking (opt-in) loyalty customers in physical stores. The rise of loyalty applications led to an increase in the deployment of Beacons technology.

The widespread of GPS/WiFi technologies are improving fast to work indoors. At the same time, lower costs and infrastructure requirements are pushing the market for other alternatives.

Beacons platforms are Google’s Eddystone and Apple’s iBeacon

Ultra-Wide-Band (UWB) Radar Imaging

Ultra Wide Band (UWB) functions in low-energy, short-range, and high-bandwidth environments. UWB comes from Radar Imaging and is entering the retail space.

UWB core advantage is accuracy, which can be 5 to 10 cm. The low power usage and location positioning accuracy are an advantage for In-Store Analytics.

RFID Location Tracking

RFID (Radio Frequency Identification) uses electromagnetic fields to track the tags attached to objects.

In retail, RFID is primarily used for supply chain and loss prevention applications by tagging and tracking the movements of “things.” As RFID adoption rate gains momentum, retailers deploy the technology to enhance the in-store customer experience.

And yet, RFID is not widely deployed in retail stores. The problem has never been the cost of tags. If you focus only on products, you miss the real variable in physical stores – the behaviors of shoppers.

QR Code (Quick Response)

QR stands for “Quick Response.” The barcode is a black-and-white optical label that offers access to information once scanned.

In physical retail, QR codes are in tags for product information. QR codes can also ignite access to more complex digital applications, such as a CRM for restaurants and bars.

NFC (Near Field Communication)

Near-Field Communication (NFC) is a set of protocols for short-range connectivity between two devices. In physical retail, the common usage is in payment applications.

The pandemic accelerated the demand for contactless checkouts, which relies on payments with NFC. You can find contactless applications in brands such as Starbucks and Showfields.

What’s the BEST Tracking Technology?

Here’s how to evaluate an in-store technology strategy QUICKLY:

Step #1: Identify Business Objectives

If you are a retailer, mall operator, or marketing agency, the first step is to identify your business objective. For example:

- If you want to send push notifications to customers, you need opt-in and opt-out features.

- If you want to know the store’s opportunity, you need an accurate measure of Visitors.

- If you want to evaluate mall store performance, you need proximity traffic and capture rate.

- If you want to improve customer engagement, you need to monitor Optimal Engage Times.

- If you want to increase product margins, you need optimization tests of Product Positioning.

By clarifying your objectives, you can evaluate the tracking technology in context to business goals and end-users.

Step #2: Identify Tracking Technology

You should not assume that people know how to evaluate technologies. Here are topics to discuss and clarify:

- ROI goals: Target consumers or improve physical locations?

- IT Architecture: Sensors or Device-Based Tracking?

- Solution Complexity: People Counting or In-Store Customer Tracking?

- End-Users: Dashboards or Mobile? What’s the desired interface?

- Analytics: Which metrics and Key Performance Indicators (KPIs)?

Once you clarified the business objectives and internal requirements, time to close the sale.

Step #3: Identify Solution Provider

There’s only one criterion that should be non-negotiable: clarity!

Below are some topics to discuss:

- Scope: because most solutions are a hybrid of technologies, focus on what matters.

- Pricing: be transparent, consistent, and scalable.

- Accuracy: accuracy depends on the audit structure—details matter.

- Analytics: not all analytics is the same.

- Services: think less about cost and more about profits and growth.

Here’s the answer.

The BEST In-Store Customer Tracking Technology is the BEST solution for the business objectives of the Client

That’s it.

Which Tracking Technology Company?

Solution providers differ in their people tracking technology, geographical location, and business models. Specifically, there are categories of players:

Category #1: People Counting (Footfall Tracking) Companies that ventured into In-Store Analytics

People Counting companies, camera-based surveillance providers, and Value-Added Resellers (VARs) are the first movers to real-time occupancy solutions and in-store customer tracking.

The VARs often create solutions from a hybrid of tracking technologies.

In addition to the companies mentioned in the product section, here are more solution providers (in alphabetical order):

- CountRite (Israel)

- Eurocam (France)

- Facit Data Systems (UK)

- Flir/Brickstream (US)

- Headcount (Canada)

- InteliPower (South Africa)

- Ipsos Retail (UK)

- Prodco (Canada)

- Pygmalios (Czech Republic)

- RealValue (France)

- RetailNext (US)

- ShopperTrak (US)

- SmartMobility (Brazil)

- Store Traffic (Canada)

- TecBrain (Spain)

- Unicross (China)

- Xpandretail (Dubai)

Category #2: Enterprise Retail Technology Providers go up the stack

Global and regional enterprise companies are providing retailers and shopping centers with installment, calibration, and professional services for people tracking solutions, including:

- Hollander Techniek (Netherlands)

- Halo Metrics (Canada)

- ASH Tech (UK)

Category #3: Marketing expertise turns toward physical retail

The goal of creating seamless digital and physical sales funnels attracts data-driven marketing companies. For example:

- AisleLabs (Canada)

- Digital Mortar (US)

- FastSensor (Brazil)

- InReality (Atlanta)

- Nurama (Brussels)

Category #4: Location Intelligence companies go Big Data Retail

Geo-Spatial Intelligence companies are introducing innovative Location Analytics in retail, for example, Esri, Orbital, and Placer.

The combination of Location Intelligence and Demand Analytics generates insights beyond the local store’s trade zone, such as food scarcity.

Category #5: The Internet of Things (IoT) is a platform and an ecosystem

Tier-1 software and consulting companies are building Internet of Things (IoT) platforms. Because the goal is an end-to-end analytics system for retail, the retail technology market had evolved into ecosystems.

Enterprises such as Intel, IBM, and Capgemini developed retail-based offers. In 2020, Zebra Technologies enhanced its workforce offer by buying Reflexis, and Cisco acquired Modcam.

Location Analytics Market worth $26.7 billion by 2025.

Markets and Markets

The Future of Retail In-Store Analytics

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s not going to change in the next 10 years?’ And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time.”

Jeff Bezos, Founder & CEO Amazon

As the coronavirus pandemic accelerated technology investments, and while foot traffic to stores and malls decreased, the customer’s intent to buy increased.

Today, the physical store is a vital hub for retailers. The stores are sales floors, distribution centers, and brand showrooms.

Tier-1 companies such as Amazon, Alibaba, and Walmart, are leading the trend to seamless online and offline retail. And consumer expectations are accelerating.

The physical store is far from dead.

With data-driven decisions, every part of store operations, marketing, and sales gets easier.